Award winning executive search to the private, and investor backed health, care, and life sciences sectors

Trusted executive search partner to the investment community delivering outstanding leaders for the healthcare and life sciences sectors

0

Mandates delivered to date

0

%

Delivery rate of all retained mandates

0

%

C-suite appointments are women

0

+

Sub-sectors in healthcare and life sciences supported

Our Sectors

We are experts at what we do

01

Our People

A dedicated team of executive search experts, delivering for you

The Compass Carter Osborne team are healthcare and life science experts. As a trusted advisor we bring decades of search experience and an unparalleled track record of delivery across our dedicated sectors for our investor clients – relied upon time and again to build outstanding leadership teams.

Familiar faces at key industry events, our expertise extends beyond the mere placing of people with our consultants bringing together sector leaders to address key challenges, working in partnership to produce tangible solutions.

02

Expertise

Unearthing rare talent, that drive successful exits

Responsive, adaptable, and emotionally intelligent, Compass Carter Osborne avoid the one-size-fits-all approach to ensure our clients achieve their desired outcome by presenting a broad range of intuitive, tailored solutions, based on specific needs.

03

Our Approach

Tailoring our offering,

to provide a bespoke service

Results driven, not process led, CCO avoid the conformity of a rigid process. Never assumptive, we listen and adopt an agreed approach which most closely delivers to a clients specific needs. Understanding the uniqueness of each role, our people tailor a search to bespoke requirements to ensure solutions that delivers the best possible results first time, every time.

A trusted advisor to the investment community

providing leaders advancing the healthcare and life sciences sectors

What our clients say

“Compass Carter Osborne really delivered for us in our search for a new CEO for Outcomes First Group. It was a vitally important assignment given that we were recruiting a successor for a long standing and highly successful CEO in a sector-leading business. Compass Carter Osborne went above and beyond in developing a deep understanding of the business and our requirements, and in only presenting candidates that closely met these. They think very creatively and their focus was very sharp; they particularly understood the culture of the business. The search was speedy and well organised, with a very high standard of verbal and written feedback. They have a granular knowledge of the sector and because of the way in which they work, we were fully involved throughout and achieved a great result. A really excellent search – thank you.”

Outcomes First Group – Chair

“Compass Carter Osborne started from the very beginning with a detailed, professional explanation of the available position. They spent time to present the great opportunity and chance to accelerate my career but at the same time, the challenge, and the strong expectation from their client.”

Hengrui Therapeutics – VP, Head Biological Drug Discovery

“Compass Carter Osborne delivered on a key appointment for the PFA and the wider football industry. It was a complex brief involving creating an entirely new position. The role was vitally important, with the successful candidate taking on a sensitive and multifaceted responsibility across CTE, concussion and brain health in professional football. CCO led a comprehensive and exhaustive process, developing a deep understanding of the union’s requirements and using his expert knowledge to help scope and evolve the brief throughout the search. The entire process was professional, efficient and well organised, with consistent communication and feedback at every stage.”

The Professional Footballers Association (PFA) – Chief Executive Officer

“I have been so impressed by Luke’s integrity, clear purpose and drive to achieve for his clients. Luke has worked with Priory on a number of things but more recently to source two independent Non Executive Directors and a Director of Talent Acquisition. He has kept us informed, fielded some great candidates and follows up at each stage, even when they have started. I would really recommend him if you are searching for high calibre individuals.”

Priory Group – Chief Executive Officer

“I recently had the pleasure of being appointed to an independent healthcare provider as a NED after being put forward for the role by Luke. Throughout the whole recruitment process I was treated with respect and felt valued. I was particularly impressed with the follow up support after the decision to appoint me, which I have never experienced from other search companies. Luke continued to check in with me to ensure my onboarding went smoothly and that I had settled into the role. Overall, a highly professional and comprehensive approach delivered personally by Luke.”

Priory – Independent Non-Executive Director

“Luke was absolutely brilliant along the journey. He acted as a real partner and was able to answer to all my questions in order to get comfortable with the decision of making the change. His expertise and knowledge of the sector really came out along the process. Most importantly, he was always available when I needed him to be, which is something I valued a lot. In summary, I couldn’t recommend him and Compass Carter Osborne enough.”

AniCura – Group Chief Operating Officer

“We worked with Compass Carter Osborne in the search for our Chief Financial Officer and from the start it was clear they were a good choice of partner. A focus on understanding our needs as a business, and mine personally as a CEO were front of mind for Paul and Kieran. They took the time to listen, understand and not only focus on the functional aspects of the role – but critically, the team fit and culture we are building.

Process, structure and follow-through were like clockwork, and the quality of candidates were of a consistently high-level. I would highly recommend Compass Carter Osborne.”

Renaiss Health – Chief Executive Officer

“I’ve known Tarquin for over 15 years, during which time he has delivered a number of executive assignments at senior level, including COO/executive team and senior management roles in scientific/professional disciplines (his network in the biotech/life-sciences sector is second-to-none!). He works hard to truly understand both the candidate brief and the culture of the company, sets realistic expectations and retains regular contact as an assignment progresses, always providing thorough updates and pragmatic advice. He has the highest levels of professionalism and integrity – he really is a pleasure to work with.”

One Nucleus – Director

“Jamie did a great job – he really took the time to understand our business, our needs and what we were looking for. We knew our brief was specific, yet Jamie met all our expectations with the search. He maintained a high standard of communication and meticulous attention to detail throughout the process. I would recommend Jamie and the Compass Carter Osborne team without hesitation.”

Melrose Education – Chair & CEO

“Our recent work with Compass Carter Osborne was exceptional. The search was perfectly organised, response times were swift, and due to the consultant market knowledge and network, we quickly found our ideal candidate.”

Schoen Clinic – Member of Group Executive

Healthcare news, data and analysis

Via Investors in Healthcare

Switzerland: Lonza completing transformation to pure-play CDMO with divestment of Capsules & Health Ingredients

Switzerland-listed Lonza has agreed to sell its Capsules & Health Ingredients (CHI) business to UK-based Lone Star Funds for an enterprise value of CHF2.3bn (US$3bn. Headquartered in Basel, CHI operates […]

Switzerland-listed Lonza has agreed to sell its Capsules & Health Ingredients (CHI) business to UK-based Lone Star Funds for an enterprise value of CHF2.3bn (US$3bn. Headquartered in Basel, CHI operates […]

Switzerland-listed Lonza has agreed to sell its Capsules & Health Ingredients (CHI) business to UK-based Lone Star Funds for an enterprise value of CHF2.3bn (US$3bn. Headquartered in Basel, CHI operates […]

Switzerland-listed Lonza has agreed to sell its Capsules & Health Ingredients (CHI) business to UK-based Lone Star Funds for an enterprise value of CHF2.3bn (US$3bn. Headquartered in Basel, CHI operates […]

Switzerland: Lonza completing transformation to pure-play CDMO with divestment of Capsules & Health Ingredients

March 9, 2026

Buy Out

M&A

News

Pharma

Public Equity

Netherlands: Battery Ventures-backed steute Technologies acquires Oldelft Ultrasound

Germany-based steute Technologies, a Battery Ventures-backed manufacturer of switches, sensors and other products that enable increased automation and safety in the medical and industrial sectors, has acquired Netherlands-based medical device […]

Germany-based steute Technologies, a Battery Ventures-backed manufacturer of switches, sensors and other products that enable increased automation and safety in the medical and industrial sectors, has acquired Netherlands-based medical device […]

Germany-based steute Technologies, a Battery Ventures-backed manufacturer of switches, sensors and other products that enable increased automation and safety in the medical and industrial sectors, has acquired Netherlands-based medical device […]

Germany-based steute Technologies, a Battery Ventures-backed manufacturer of switches, sensors and other products that enable increased automation and safety in the medical and industrial sectors, has acquired Netherlands-based medical device […]

Netherlands: Battery Ventures-backed steute Technologies acquires Oldelft Ultrasound

March 6, 2026

Buy Out

Life Sciences

M&A

Medtech – Medical Devices and Implants

News

Finland: Evondos Group makes key leadership appointments to support European growth

Finland-based Evondos Group, a European health-tech provider, has announced the appointment of two senior executives to support rapid growth plans: Tom Ellison will take up the role of CFO, while […]

Finland-based Evondos Group, a European health-tech provider, has announced the appointment of two senior executives to support rapid growth plans: Tom Ellison will take up the role of CFO, while […]

Finland-based Evondos Group, a European health-tech provider, has announced the appointment of two senior executives to support rapid growth plans: Tom Ellison will take up the role of CFO, while […]

Finland-based Evondos Group, a European health-tech provider, has announced the appointment of two senior executives to support rapid growth plans: Tom Ellison will take up the role of CFO, while […]

Finland: Evondos Group makes key leadership appointments to support European growth

March 6, 2026

Homecare

Life Sciences

Medtech – Medical Devices and Implants

News

People

Germany: New shareholders join AMW to support long-term growth aspirations

Germany-based AMW, a specialty pharmaceutical company focused on biodegradable controlled-release drug delivery systems, has announced a change in its shareholder structure. Ren Life Sciences, a specialist investment firm focused on […]

Germany-based AMW, a specialty pharmaceutical company focused on biodegradable controlled-release drug delivery systems, has announced a change in its shareholder structure. Ren Life Sciences, a specialist investment firm focused on […]

Germany-based AMW, a specialty pharmaceutical company focused on biodegradable controlled-release drug delivery systems, has announced a change in its shareholder structure. Ren Life Sciences, a specialist investment firm focused on […]

Germany-based AMW, a specialty pharmaceutical company focused on biodegradable controlled-release drug delivery systems, has announced a change in its shareholder structure. Ren Life Sciences, a specialist investment firm focused on […]

Germany: New shareholders join AMW to support long-term growth aspirations

March 6, 2026

Buy Out

Life Sciences

M&A

Medtech – Medical Devices and Implants

News

UK: EHP’s new investor commitment underscores continued confidence in UK real estate

In its H2 2025 update, Elevation Healthcare Properties (EHP), a specialist private open-ended healthcare REIT focused on UK needs-based senior housing, has confirmed that a new institutional commitment has been […]

In its H2 2025 update, Elevation Healthcare Properties (EHP), a specialist private open-ended healthcare REIT focused on UK needs-based senior housing, has confirmed that a new institutional commitment has been […]

In its H2 2025 update, Elevation Healthcare Properties (EHP), a specialist private open-ended healthcare REIT focused on UK needs-based senior housing, has confirmed that a new institutional commitment has been […]

In its H2 2025 update, Elevation Healthcare Properties (EHP), a specialist private open-ended healthcare REIT focused on UK needs-based senior housing, has confirmed that a new institutional commitment has been […]

UK: EHP’s new investor commitment underscores continued confidence in UK real estate

March 5, 2026

Care Homes

News

Real Assets

Social Care

EHP

France: Astorg portfolio company Solabia accelerates expansion plan with three strategic acquisitions

Astorg portfolio company, Paris-headquartered Solabia, a producer of natural active ingredients for the cosmetics, nutraceutical, pharmaceutical, food and clinical testing industries, has signed definitive agreements to acquire three complementary businesses […]

Astorg portfolio company, Paris-headquartered Solabia, a producer of natural active ingredients for the cosmetics, nutraceutical, pharmaceutical, food and clinical testing industries, has signed definitive agreements to acquire three complementary businesses […]

Astorg portfolio company, Paris-headquartered Solabia, a producer of natural active ingredients for the cosmetics, nutraceutical, pharmaceutical, food and clinical testing industries, has signed definitive agreements to acquire three complementary businesses […]

Astorg portfolio company, Paris-headquartered Solabia, a producer of natural active ingredients for the cosmetics, nutraceutical, pharmaceutical, food and clinical testing industries, has signed definitive agreements to acquire three complementary businesses […]

France: Astorg portfolio company Solabia accelerates expansion plan with three strategic acquisitions

March 5, 2026

Articles

Consumer Healthcare

Cosmetic & Aesthetics

Healthcare

M&A

Sweden: Northern Horizon secures new equity commitments of €140m for ACSIF

Copenhagen-headquartered Northern Horizon, a specialised social infrastructure investment manager in the Nordics, has completed a capital raise of €140m (US$162m) for its Aged Care Social Infrastructure Fund (ACSIF). “We accelerated […]

Copenhagen-headquartered Northern Horizon, a specialised social infrastructure investment manager in the Nordics, has completed a capital raise of €140m (US$162m) for its Aged Care Social Infrastructure Fund (ACSIF). “We accelerated […]

Copenhagen-headquartered Northern Horizon, a specialised social infrastructure investment manager in the Nordics, has completed a capital raise of €140m (US$162m) for its Aged Care Social Infrastructure Fund (ACSIF). “We accelerated […]

Copenhagen-headquartered Northern Horizon, a specialised social infrastructure investment manager in the Nordics, has completed a capital raise of €140m (US$162m) for its Aged Care Social Infrastructure Fund (ACSIF). “We accelerated […]

Sweden: Northern Horizon secures new equity commitments of €140m for ACSIF

March 5, 2026

Care Homes

News

Real Assets

Social Care

Andrew Smith

Belgium: Aedifica to proceed with Cofinimmo merger following strong results to Exchange Offer

Belgium-based healthcare real estate REIT, Aedifica has reported a strong result after the initial acceptance period for Aedifica’s Exchange Offer on Cofinimmo. During the initial acceptance period (30 January to […]

Belgium-based healthcare real estate REIT, Aedifica has reported a strong result after the initial acceptance period for Aedifica’s Exchange Offer on Cofinimmo. During the initial acceptance period (30 January to […]

Belgium-based healthcare real estate REIT, Aedifica has reported a strong result after the initial acceptance period for Aedifica’s Exchange Offer on Cofinimmo. During the initial acceptance period (30 January to […]

Belgium-based healthcare real estate REIT, Aedifica has reported a strong result after the initial acceptance period for Aedifica’s Exchange Offer on Cofinimmo. During the initial acceptance period (30 January to […]

Belgium: Aedifica to proceed with Cofinimmo merger following strong results to Exchange Offer

March 4, 2026

Care Homes

M&A

News

Public Equity

Real Assets

UK: PK Consumer Health makes second acquisition in VMS platform build

Consumer healthcare platform, PK Consumer Health, a portfolio company of Avista Healthcare Partners and Damier Group, is pleased to announce that it has signed an agreement to acquire UK-based HealthAid, […]

Consumer healthcare platform, PK Consumer Health, a portfolio company of Avista Healthcare Partners and Damier Group, is pleased to announce that it has signed an agreement to acquire UK-based HealthAid, […]

Consumer healthcare platform, PK Consumer Health, a portfolio company of Avista Healthcare Partners and Damier Group, is pleased to announce that it has signed an agreement to acquire UK-based HealthAid, […]

Consumer healthcare platform, PK Consumer Health, a portfolio company of Avista Healthcare Partners and Damier Group, is pleased to announce that it has signed an agreement to acquire UK-based HealthAid, […]

UK: PK Consumer Health makes second acquisition in VMS platform build

March 4, 2026

Buy Out

Consumer Healthcare

Healthcare

M&A

News

UK Healthcare Real Estate: structural demand and under supply attracting record capital flows

Record transaction volumes and significant North American capital inflows have, over the past year, cemented the UK as Europe’s preferred destination for healthcare real estate investment. Structural demand growth — […]

Record transaction volumes and significant North American capital inflows have, over the past year, cemented the UK as Europe’s preferred destination for healthcare real estate investment. Structural demand growth — […]

Record transaction volumes and significant North American capital inflows have, over the past year, cemented the UK as Europe’s preferred destination for healthcare real estate investment. Structural demand growth — […]

Record transaction volumes and significant North American capital inflows have, over the past year, cemented the UK as Europe’s preferred destination for healthcare real estate investment. Structural demand growth — […]

UK Healthcare Real Estate: structural demand and under supply attracting record capital flows

March 4, 2026

Analysis

Care Homes

Healthcare

Hospitals and Clinics

News

Sweden: Urban Partners divests six modern Swedish care assets

Urban Partners, a developer and manager of real-estate in prime locations across Northern Europe, has announced the divestment of six modern care and nursing homes in Sweden to Northern Horizon’s […]

Urban Partners, a developer and manager of real-estate in prime locations across Northern Europe, has announced the divestment of six modern care and nursing homes in Sweden to Northern Horizon’s […]

Urban Partners, a developer and manager of real-estate in prime locations across Northern Europe, has announced the divestment of six modern care and nursing homes in Sweden to Northern Horizon’s […]

Urban Partners, a developer and manager of real-estate in prime locations across Northern Europe, has announced the divestment of six modern care and nursing homes in Sweden to Northern Horizon’s […]

Sweden: Urban Partners divests six modern Swedish care assets

March 4, 2026

Care Homes

M&A

M&A Deals

News

Real Assets

UK: Puma accelerates delivery of new UK care beds with £150m care loans provided in 2025

Puma Property Finance provided over £150m (US$199m) of care home loans in 2025, creating approximately 800 new care beds across the UK. Added to the existing schemes under construction, Puma […]

Puma Property Finance provided over £150m (US$199m) of care home loans in 2025, creating approximately 800 new care beds across the UK. Added to the existing schemes under construction, Puma […]

Puma Property Finance provided over £150m (US$199m) of care home loans in 2025, creating approximately 800 new care beds across the UK. Added to the existing schemes under construction, Puma […]

Puma Property Finance provided over £150m (US$199m) of care home loans in 2025, creating approximately 800 new care beds across the UK. Added to the existing schemes under construction, Puma […]

UK: Puma accelerates delivery of new UK care beds with £150m care loans provided in 2025

March 3, 2026

Analysis

Care Homes

News

Real Assets

Social Care

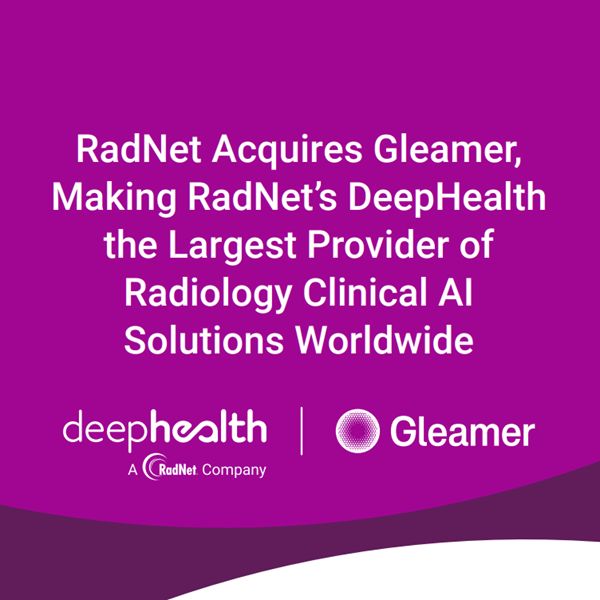

France: RadNet acquires Gleamer for up to €230m

Nasdaq-listed RadNet, a US-based outpatient diagnostic imaging services company, has acquired Gleamer a France-based radiology AI company based in Paris, France, to be integrated into DeepHealth, RadNet’s wholly owned subsidiary. […]

Nasdaq-listed RadNet, a US-based outpatient diagnostic imaging services company, has acquired Gleamer a France-based radiology AI company based in Paris, France, to be integrated into DeepHealth, RadNet’s wholly owned subsidiary. […]

Nasdaq-listed RadNet, a US-based outpatient diagnostic imaging services company, has acquired Gleamer a France-based radiology AI company based in Paris, France, to be integrated into DeepHealth, RadNet’s wholly owned subsidiary. […]

Nasdaq-listed RadNet, a US-based outpatient diagnostic imaging services company, has acquired Gleamer a France-based radiology AI company based in Paris, France, to be integrated into DeepHealth, RadNet’s wholly owned subsidiary. […]

France: RadNet acquires Gleamer for up to €230m

March 3, 2026

Diagnostics

Healthcare

Life Sciences

M&A

Medtech – Hospital Equipment

Netherlands: FYEO enters into strategic partnership with EuroEyes

Germany-based EuroEyes, an international specialist in refractive surgery, has acquired Committed Capital’s majority stake in FYEO, the largest clinic for uninsured refractive surgery in the Netherlands. “This step marks an […]

Germany-based EuroEyes, an international specialist in refractive surgery, has acquired Committed Capital’s majority stake in FYEO, the largest clinic for uninsured refractive surgery in the Netherlands. “This step marks an […]

Germany-based EuroEyes, an international specialist in refractive surgery, has acquired Committed Capital’s majority stake in FYEO, the largest clinic for uninsured refractive surgery in the Netherlands. “This step marks an […]

Germany-based EuroEyes, an international specialist in refractive surgery, has acquired Committed Capital’s majority stake in FYEO, the largest clinic for uninsured refractive surgery in the Netherlands. “This step marks an […]

Netherlands: FYEO enters into strategic partnership with EuroEyes

March 2, 2026

Healthcare

M&A

News

Ophthalmology

Albert van der Wal

Europe: NorthWest sells portfolio of European properties to TPG Real Estate for €400m

In its fourth quarter results announcement on 24 February, Canada-based NorthWest Healthcare Property REIT reached an agreement to sell a combined portfolio of 33 European properties to TPG Real Estate […]

In its fourth quarter results announcement on 24 February, Canada-based NorthWest Healthcare Property REIT reached an agreement to sell a combined portfolio of 33 European properties to TPG Real Estate […]

In its fourth quarter results announcement on 24 February, Canada-based NorthWest Healthcare Property REIT reached an agreement to sell a combined portfolio of 33 European properties to TPG Real Estate […]

In its fourth quarter results announcement on 24 February, Canada-based NorthWest Healthcare Property REIT reached an agreement to sell a combined portfolio of 33 European properties to TPG Real Estate […]

Europe: NorthWest sells portfolio of European properties to TPG Real Estate for €400m

March 2, 2026

Healthcare

Hospitals and Clinics

M&A

M&A Deals

News

UK: Boehringer Ingelheim licenses novel oral therapeutics programme for immune diseases from Sitryx Therapeutics

Boehringer Ingelheim has acquired an exclusive license for a preclinical, small molecule programme from Sitryx Therapeutics, a UK-based clinical-stage biopharmaceutical company developing novel oral therapies to restore immune balance in […]

Boehringer Ingelheim has acquired an exclusive license for a preclinical, small molecule programme from Sitryx Therapeutics, a UK-based clinical-stage biopharmaceutical company developing novel oral therapies to restore immune balance in […]

Boehringer Ingelheim has acquired an exclusive license for a preclinical, small molecule programme from Sitryx Therapeutics, a UK-based clinical-stage biopharmaceutical company developing novel oral therapies to restore immune balance in […]

Boehringer Ingelheim has acquired an exclusive license for a preclinical, small molecule programme from Sitryx Therapeutics, a UK-based clinical-stage biopharmaceutical company developing novel oral therapies to restore immune balance in […]

UK: Boehringer Ingelheim licenses novel oral therapeutics programme for immune diseases from Sitryx Therapeutics

February 27, 2026

News

Pharma

Boehringer Ingelheim

Carine Boustany

Iain Kilty

Weight Partners: from post-crisis consumer investing to specialist healthcare focus

Private equity investor Weight Partners Capital (WPC) was founded in 2009 by Jim Weight, targeting sectors where the team had direct operational experience. In the aftermath of the financial crisis, […]

Private equity investor Weight Partners Capital (WPC) was founded in 2009 by Jim Weight, targeting sectors where the team had direct operational experience. In the aftermath of the financial crisis, […]

Private equity investor Weight Partners Capital (WPC) was founded in 2009 by Jim Weight, targeting sectors where the team had direct operational experience. In the aftermath of the financial crisis, […]

Private equity investor Weight Partners Capital (WPC) was founded in 2009 by Jim Weight, targeting sectors where the team had direct operational experience. In the aftermath of the financial crisis, […]

Weight Partners: from post-crisis consumer investing to specialist healthcare focus

February 27, 2026

Analysis

Care Homes

Complex Behavioural Care

Healthcare

News

GLP-1 2.0: Where the next wave of value will be created

Authors Dr Lakshiv Dhingra, Dr Seren Marsh, Abhishek Patel and Dr Victor Chua of Mansfield Advisors consider how the GLP-1 landscape will evolve over the next 10 years in light […]

Authors Dr Lakshiv Dhingra, Dr Seren Marsh, Abhishek Patel and Dr Victor Chua of Mansfield Advisors consider how the GLP-1 landscape will evolve over the next 10 years in light […]

Authors Dr Lakshiv Dhingra, Dr Seren Marsh, Abhishek Patel and Dr Victor Chua of Mansfield Advisors consider how the GLP-1 landscape will evolve over the next 10 years in light […]

Authors Dr Lakshiv Dhingra, Dr Seren Marsh, Abhishek Patel and Dr Victor Chua of Mansfield Advisors consider how the GLP-1 landscape will evolve over the next 10 years in light […]

GLP-1 2.0: Where the next wave of value will be created

February 27, 2026

Analysis

Consumer Healthcare

Cosmetic & Aesthetics

Healthcare

Manufacturing – Generics

Germany: KKR-backed Clinisupplies acquires SmartHomecare from Captiva UG and aiutanda

In 2025, Captiva UG together with aiutanda GmbH, sold Germany-based SmartHomecare to UK-based Clinisupplies, a manufacturer of urology products and a leading out-of-hospital provider, as part of a 100 percent […]

In 2025, Captiva UG together with aiutanda GmbH, sold Germany-based SmartHomecare to UK-based Clinisupplies, a manufacturer of urology products and a leading out-of-hospital provider, as part of a 100 percent […]

In 2025, Captiva UG together with aiutanda GmbH, sold Germany-based SmartHomecare to UK-based Clinisupplies, a manufacturer of urology products and a leading out-of-hospital provider, as part of a 100 percent […]

In 2025, Captiva UG together with aiutanda GmbH, sold Germany-based SmartHomecare to UK-based Clinisupplies, a manufacturer of urology products and a leading out-of-hospital provider, as part of a 100 percent […]

Germany: KKR-backed Clinisupplies acquires SmartHomecare from Captiva UG and aiutanda

February 26, 2026

Consumer Healthcare

Healthcare

M&A

News

aiutanda

UK: Richard Sanders steps down as managing partner at Sullivan Street Partners

Sullivan Street Partners (SSP), an investment firm focused on lower mid-market buyouts in UK and Ireland, has announced that founding partner Richard Sanders is stepping down from his role as […]

Sullivan Street Partners (SSP), an investment firm focused on lower mid-market buyouts in UK and Ireland, has announced that founding partner Richard Sanders is stepping down from his role as […]

Sullivan Street Partners (SSP), an investment firm focused on lower mid-market buyouts in UK and Ireland, has announced that founding partner Richard Sanders is stepping down from his role as […]

Sullivan Street Partners (SSP), an investment firm focused on lower mid-market buyouts in UK and Ireland, has announced that founding partner Richard Sanders is stepping down from his role as […]

UK: Richard Sanders steps down as managing partner at Sullivan Street Partners

February 26, 2026

Healthcare

News

People

Richard Sanders

Sullivan Street Partners

Lithuania: Biomapas appoints Xavier Duburcq as CEO as it accelerates towards €200m-plus ambition

Biomapas, a pan-European pharma services provider based in Lithuania, has appointed Xavier Duburcq as CEO, marking the start of a new chapter as the company prepares to accelerate its next phase of growth. He succeeds David […]

Biomapas, a pan-European pharma services provider based in Lithuania, has appointed Xavier Duburcq as CEO, marking the start of a new chapter as the company prepares to accelerate its next phase of growth. He succeeds David […]

Biomapas, a pan-European pharma services provider based in Lithuania, has appointed Xavier Duburcq as CEO, marking the start of a new chapter as the company prepares to accelerate its next phase of growth. He succeeds David […]

Biomapas, a pan-European pharma services provider based in Lithuania, has appointed Xavier Duburcq as CEO, marking the start of a new chapter as the company prepares to accelerate its next phase of growth. He succeeds David […]

Lithuania: Biomapas appoints Xavier Duburcq as CEO as it accelerates towards €200m-plus ambition

February 26, 2026

News

People

Pharma

Services – CRO/CMO/CDMO

Biomapas

UK: Reframe Cancer acquires digital cancer prehabilitation business Alvie Health

Reframe Cancer, a UK-based provider of specialist cancer navigation, has acquired digital cancer prehabilitation business Alvie Health. The deal strengthens Reframe Cancer’s position as a comprehensive, end‑to‑end cancer support provider […]

Reframe Cancer, a UK-based provider of specialist cancer navigation, has acquired digital cancer prehabilitation business Alvie Health. The deal strengthens Reframe Cancer’s position as a comprehensive, end‑to‑end cancer support provider […]

Reframe Cancer, a UK-based provider of specialist cancer navigation, has acquired digital cancer prehabilitation business Alvie Health. The deal strengthens Reframe Cancer’s position as a comprehensive, end‑to‑end cancer support provider […]

Reframe Cancer, a UK-based provider of specialist cancer navigation, has acquired digital cancer prehabilitation business Alvie Health. The deal strengthens Reframe Cancer’s position as a comprehensive, end‑to‑end cancer support provider […]

UK: Reframe Cancer acquires digital cancer prehabilitation business Alvie Health

February 26, 2026

Digital Health/Healthtech

Healthcare

M&A

News

Alvie Health

UK: Sovereign Capital Partners backs Apollo Home Healthcare’s next phase of growth

UK buy-and-build PE firm, Sovereign Capital Partners, has acquired Apollo Home Healthcare, a provider of complex healthcare-at-home services across the Midlands, North, and East of England. Sovereign’s investment will support […]

UK buy-and-build PE firm, Sovereign Capital Partners, has acquired Apollo Home Healthcare, a provider of complex healthcare-at-home services across the Midlands, North, and East of England. Sovereign’s investment will support […]

UK buy-and-build PE firm, Sovereign Capital Partners, has acquired Apollo Home Healthcare, a provider of complex healthcare-at-home services across the Midlands, North, and East of England. Sovereign’s investment will support […]

UK buy-and-build PE firm, Sovereign Capital Partners, has acquired Apollo Home Healthcare, a provider of complex healthcare-at-home services across the Midlands, North, and East of England. Sovereign’s investment will support […]

UK: Sovereign Capital Partners backs Apollo Home Healthcare’s next phase of growth

February 25, 2026

Buy Out

Homecare

M&A

News

Social Care

UK: Jason Arnold joins Piper Sandler’s healthcare IB group as managing director

Piper Sandler, has appointed Jason Arnold as a managing director in the healthcare investment banking group. Arnold will be initially based in London while serving clients globally. He will be advising life science tools […]

Piper Sandler, has appointed Jason Arnold as a managing director in the healthcare investment banking group. Arnold will be initially based in London while serving clients globally. He will be advising life science tools […]

Piper Sandler, has appointed Jason Arnold as a managing director in the healthcare investment banking group. Arnold will be initially based in London while serving clients globally. He will be advising life science tools […]

Piper Sandler, has appointed Jason Arnold as a managing director in the healthcare investment banking group. Arnold will be initially based in London while serving clients globally. He will be advising life science tools […]

UK: Jason Arnold joins Piper Sandler’s healthcare IB group as managing director

February 25, 2026

Healthcare

News

People

Jason Arnold

Piper Sandler

UK: Clarivate shares jump higher on announcement of plans to sell Life Sciences & Healthcare business

UK-headquartered, US-listed Clarivate’s stock price rose by almost 40% on the release of the firm’s decision to sell its Life Sciences & Healthcare business from US$1.68 to US$2.35. In its […]

UK-headquartered, US-listed Clarivate’s stock price rose by almost 40% on the release of the firm’s decision to sell its Life Sciences & Healthcare business from US$1.68 to US$2.35. In its […]

UK-headquartered, US-listed Clarivate’s stock price rose by almost 40% on the release of the firm’s decision to sell its Life Sciences & Healthcare business from US$1.68 to US$2.35. In its […]

UK-headquartered, US-listed Clarivate’s stock price rose by almost 40% on the release of the firm’s decision to sell its Life Sciences & Healthcare business from US$1.68 to US$2.35. In its […]

UK: Clarivate shares jump higher on announcement of plans to sell Life Sciences & Healthcare business

February 25, 2026

Healthcare

Life Sciences

M&A

News

Pharma

The latest insights from

Compass Carter Osborne

Insights from the Investors in Healthcare Real Assets Conference

Insights from the Investors in Healthcare Real Assets Conference

February 9, 2026

Healthcare

Insight

Digital transformation or change fatigue? Navigating tech in health and care

Digital transformation or change fatigue? Navigating tech in health and care

November 24, 2025

Healthcare

Insight

Culture in flux: rebuilding trust in a multi-generational workforce

Culture in flux: rebuilding trust in a multi-generational workforce

October 24, 2025

Healthcare

Insight

Speak to our experts

Whether you’re looking to secure talented leaders for your business, or find a new role, Compass Carter Osborne can be trusted to deliver.